Once you leave the U.S., medical services, costs and insurance all change. Here are some ways of going foreign and being covered. (published April 2014)

For the last few years, health insurance has been a topic near the top of the news and on many American’s minds as we adapt to the new laws and policies under the Affordable Care Act. No matter how you feel about the law, the debate that has surrounded its passing and implementation has underscored both the strengths and weaknesses of the U.S.’s market driven, private insurance medical system.

Those of us who have cruised the world and lived for extended periods of time in foreign countries are aware that the rest of the world does medicine differently. In all of the developed world, outside the U.S., and in most of the developing world, essential health care is provided as a fairly low cost public service. And we as expats, travelers, cruisers and visitors are allowed to make use of these public health services at costs that can be as low as 10-percent of a similar medical expense in the U.S.

So when we are talking about health insurance for cruisers who are going foreign but maintaining a base at home in the U.S., we are talking about two distinct insurance issues; one that deals with medical issues outside the U.S. and one that deals with medical services inside the U.S. And then there is the issue of repatriation to the U.S.

When thinking about going foreign, it is good to remember the obvious fact that people get sick everywhere and there are doctors and hospitals all over the world. In the developed world, the medical infrastructure is just as good as you will find in the U.S. and provided at a much lower cost. In the developing world, you will find many dedicated and skilled doctors and nurses who have been trained in the U.S., U.K., France and other top medical school countries. But, in the developing world, medical facilities, apparatus and stocks of medicines will be much more problematical so you may need to travel to a modern country or the U.S. for treatment of serious illnesses or for a long hospital stay.

INSURANCE ABROAD

Your standard insurance policy that covers you in the U.S. may not pay medical bills in foreign countries. So, you need to weigh your options for a different approach.

For cruisers on small budgets, many will opt to carry no health insurance while outside the U.S. and will rely solely on the services in whatever country they are visiting and pay for those services in cash. Because routine medical care such as dental work, small broken bones, infections, trauma and so forth are common and the locals often pay for their own care in cash, you will find that care will be remarkably inexpensive.

Yet, traveling without insurance involves obvious risks. If you have a serious accident, a heart attack or develop a serious long term disease, you can run the risk of not being able to find and get the quality of care that you need. And if you have assets that you need to protect, you will probably want to carry insurance to cover you while abroad. In many cases, cruisers will opt for insurance policies with high deductibles and self insure for routine medical services abroad because the cost of paying cash will be less than the premiums you will need to pay for a low deductable policy.

There are quite a few insurance companies that offer offshore policies for employees of U.S. companies who are working in branches overseas. Some of these will be right for individuals and families sailing in their own boats and some will not.

In our experience, it is best to consult with an insurance broker who is affiliated with a range of insurance companies so you can weigh the pros and cons of various policies and then work with the broker to find the one that fits your needs and your budget. In the cruising and sailing market, International Marine Insurance Services has spent decades working with cruisers and insurance companies to find the best health policies. IMIS’s president Al Golden knows this field better than just about anyone and his team can certainly steer you to policies that work for you.

Pantaenius, a well-respected insurer of yachts and cruising boats worldwide, is introducing a new health insurance program for their clients in 2014. While they have not yet announced the details, we are assured that the health programs will live up to the high quality of their yacht insurance programs.

WHAT ABOUT COMING HOME?

Most cruisers have strong ties at home and even when they are out exploring the world they are still part of their former lives. Some have aging parents who need help from time to time. Some have grandchildren who need to have their grandparents around (or is it the other way around?). So, many American cruisers find themselves traveling back to the U.S. at least once a year if not more often.

Most BWS readers would not want to be in the U.S. without some kind of health insurance policy. The trick is to figure out what risk you are willing to take in terms of a deductible on a U.S. insurance policy versus the cost of a policy that you might only need for a few weeks a year.

Under the new ACA, there are some Bronze policies that have high deductibles and fairly low premiums that might be right for those of us who are sailing abroad but return to the states regularly.

Another approach is to find an international insurance policy for the rest of the world that will also cover you when you are in the U.S. There are several plans out there and you will find that adding U.S. coverage will roughly double the cost of the monthly premiums. But, you will be covered when you are back home.

OVER 65?

As we slide by this age milestone, we move into a new world of insurance and health care both in the U.S. and abroad. With Medicare Plans A and B, plus the drug option and supplemental insurance that many people buy, we have pretty comprehensive and quite affordable health insurance in the U.S. for the over 65 set.

There are several options to weigh when signing up for Medicare and the other policies. For cruisers, one of the options to consider is to sign up for a program that offers $50,000 in foreign travel health coverage. This annual amount will see you through most routine medical services and procedures outside the U.S. and, should you need to fly home for more intensive care, then you still have the Medicare and supplemental policy to cover the U.S. medical bills.

Spend time with an insurance broker who is thoroughly familiar with the ins and outs of Medicare A and B and supplemental insurance before making your policy choices. You will find that these programs offer a lot of value for the money.

Also, under Medicare there are rules governing eligibility for certain programs and windows of time in which you can sign up for certain levels of coverage. Make sure you do not lose your preferred coverage by dropping it for a few years when you go cruising. You may not be able to sign up again for the levels of coverage you want when you return to life in the U.S.

REPATRIATION

Although a rare occurrence in the cruising fleet, there are times when the best medical decision will be to fly home as quickly as possible for treatment. Some of the international and expat policies make provisions for repatriation and some do not. Be sure to raise the issue with your broker as you are discussing policy options.

Many cruising folk have discovered the Divers Alert Network (DAN), which is a non-profit organization for SCUBA divers. For a $35 annual membership, you get access to a range of useful services for sailors cruising about the world. Perhaps the most valuable of these is $100,000 of insurance that is designated specifically for covering the expenses of getting home and to a hospital or medical facility from a foreign country.

While the DAN insurance programs are nominally for divers, the organization accepts all types of members and provides the same services to all members whether your need for a medical repatriation is due to a diving accident or not.

INSURANCE AND YOU

In the end, the decisions you need to make about health insurance while cruising the world will be personal ones. Talk it over with your family doctor and learn as much as you can about the options for policies out there. Then, go to an experienced broker who can steer you to the programs that fit your medical needs and cruising budget. As it is at home, the cost of insurance will end up being one of the significant line items in your monthly cruising budget, so make sure you are getting the policies you need.

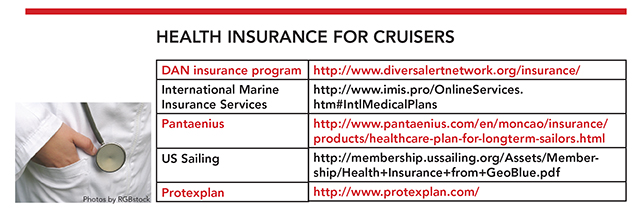

DAN insurance program http://www.diversalertnetwork.org/insurance/

International Marine Insurance Services http://www.imis.pro/OnlineServices.htm#IntlMedicalPlans

Pantaenius http://www.pantaenius.com/en/moncao/insurance/products/healthcare-plan-for-longterm-sailors.html

US Sailing http://membership.ussailing.org/Assets/Membership/Health+Insurance+from+GeoBlue.pdf

Protexplan http://www.protexplan.com